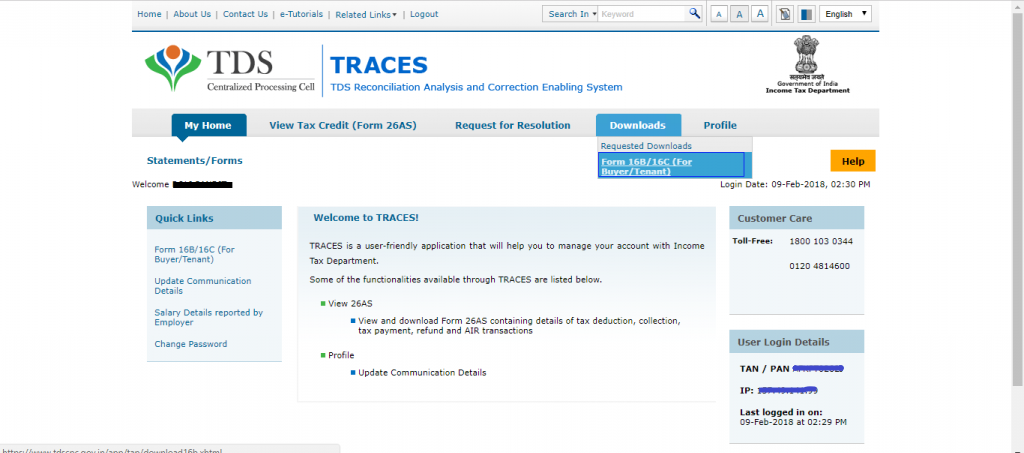

Since the inception of the Real Estate Regulatory Authority (RERA) Act in 2016, the RERA along with the respective State RERA organizations continue to work for safeguarding the interests of homebuyers. These state-specific bodies have boosted transparency in the real estate sector and have established some mandatory rules for buyers and developers as well. MahaRERA, the RERA body for Maharashtra, is a state-recognized organization that helps home buyers and also works toward promoting transparent transactions in the real estate sector.

Implementation of the RERA Act brought significant relief to home buyers at various stages and eliminated several malpractices in the real estate market. The authority not only protected the interests of innocent buyers but also initiated strict action on delayed possessions, changes in area calculations, extra charges, etc. But to avail of these benefits, home buyers must be aware of their rights and exercise them when they face any breach of trust between the two parties.

Here, we will elaborate upon various rights and responsibilities of home buyers defined by MahaRERA.

Rights of home buyers

Section 19 under Chapter 5 of the RERA Act, 2016 lays down certain rights of home buyers which have been listed below:

1. Construction schedule and date of completion

Each home buyer has the right to know about the completion date and phase-wise construction schedule. This information must comprise basic services such as water supply, electricity, sanitation, etc.

2. Information about a project

Home buyers have the right to know detailed information about any housing project before purchasing a home such as layout plans and specifications, approvals from authorities on sanctioned plans and specifications, and clauses mentioned in the sales agreement.

3. Possession

Every home buyer is entitled to claim the possession of his house/apartment, whereas the apartment owner’s association is entitled to claim the passion of the common area including lifts, lobbies, amenities, etc.

4. Documentation

Home buyers have the right to keep property documents, once he/she obtains physical possession of the house.

5. Refund

In case a developer is unable to complete give possession of the property, the buyer can claim a complete refund of the amount paid for the property. Besides, home buyers can also register a complaint with the RERA to charge an interest on the refund amount along with compensation from the developer. Moreover, if the home buyer is not satisfied with the RERA’s order on a complaint he/she can also file an appeal with the Appellate Tribunal.

With every ‘Right’ there comes a ‘Responsibility’ too, so MahaRERA has also defined some responsibilities for home buyers.

Responsibilities of home buyers

Further, Section 19 under Chapter 5 of the RERA Act, 2016 also states certain responsibilities of home buyers as listed below:

1. Possession within two months

Home buyers must take physical possession of the house within 60 days after the developer receives the occupancy certificate from the development authorities.

2. Timely payment

Home buyers are mandated to pay all the amounts at regular intervals agreed upon in the sales deed with the developer along with maintenance charges, municipal taxes, electricity and water charges, registration charges, etc. Developers can levy interest on the pending payments in case of respective installments or other charges.

3. Property Registration

Home buyers must register the property and should participate in the formation of the Apartment Owners’ Association (AOA) or Residents Welfare Association (RWA), after taking possession of the property.

Recently MahaRERA has also made mandatory disclosure of the sold or booked inventories to avoid multiple transactions for the same property. The move will further safeguard home buyers and bring more transparency in the real estate sector. The regulatory body has also asked all the home buyers to check the legal title of the property they are planning to own a house, as it has discontinued the sale of a property without a legal title. Home buyers can also check the detail of a project title on the MahaRERA website. The regulatory body also suggests home buyers crosscheck the project details such as project title, rights, interest, land seller’s name, and the land is free from any encumbrances.