The aspect of homeownership is of a great emotional value. It is indeed a journey of different milestones, right from identifying and finalizing the home through a series of documentations and number of payments across periods of time. In case of every home bought, the parameter of ‘advance payments’ leads the equation.

The concept of advanced payments

In smaller or larger transactions, apart from the purpose of the transaction, there is a principal process called “peace of mind” which runs in parallel. This process is significant, especially in larger transactions, and advance payment initiates it. Advance payment is a payment made prior to the final sale. It is a small amount, usually amounting to 1 -2% of the property value. It safeguards the buyer’s interest, and the developer gives an assurance that the house has been booked for the homebuyer.

Relation of advanced payments and the developer

Buyers usually have a budget and certain criterion for the property to be bought. Homebuyers usually search for a few properties that fit their criteria. Post that they finalize one. Thus developers need to decipher that who is a serious homebuyer.

This is the scenario where the developer asks for an advance payment. Some developers also choose not to discuss some terms of the selling transaction till they are sure that the purchaser genuinely have interest.

Types of advanced payments

Since decades, advance payments are existent. It has become a kind of custom or financial trend of business. At times, developers ask more than the advance payment. The maximum percentage, a developer can ask is 10 %.

Now, let us have a look at the five types of advance payments.

Type 1 – Earnest money deposit

Earnest Money Deposit (EMD) is the amount of money paid by a buyer to a developer as a good will expressing his interest in the purchase. Thereafter, buyer arranges the balance amount to complete the transaction in a period defined by the developer.

Type 2 – Tax deducted at source

TDS is amongst the first part of advance payment which has to be paid to the government. This tax is to be paid by the homebuyer, on behalf of the developer by deducting the amount from the final amount of the property value. At the time of disbursement of funds, most banks demand that buyer should pay it in advance and submit the TDS certificate to the bank and the developer. By furnishing with Permanent Account Number (PAN) of buyer and developer, TDS of 1% of the final value of the property is to be deducted if the property is valued more than Rs. 50 lacs. For example, if the property is worth Rs.70 lacs, the TDS will be Rs. 70,000/-.

Type 3 – Token money

For a purchase deal of property to be initiated the homebuyer has to show his genuine interest in buying by paying small percentage of the total property value to the developer. This small amount is referred to token money. Generally, to be on a safer side, a legal document is made along with the token money.

Type 4 – Booking amount

This is another type of advance payment, where the buyer pays a certain percentage of the property value to the developer. Instead of just having a receipt of the booking amount, it is advisable that a sale agreement is registered at the time of payment. The property is blocked under the name of the buyer so that the developer cannot make any other sale agreement. Also, it safeguards the buyer for the booking amount paid by them. Some developers have started to allow customers to book a house from INR 9999 as well.

For example, a 500 sq.ft apartment in an under construction building in Vile Parle @ Rs.35,000 per sq.ft valued to Rs. 1.5 crores, a buyer pays Rs. 70,000 as booking amount along with sale agreement. Balance amount may be agreed to be paid as per the milestones of the project.

Type 5 – Stamp Duty and Registration

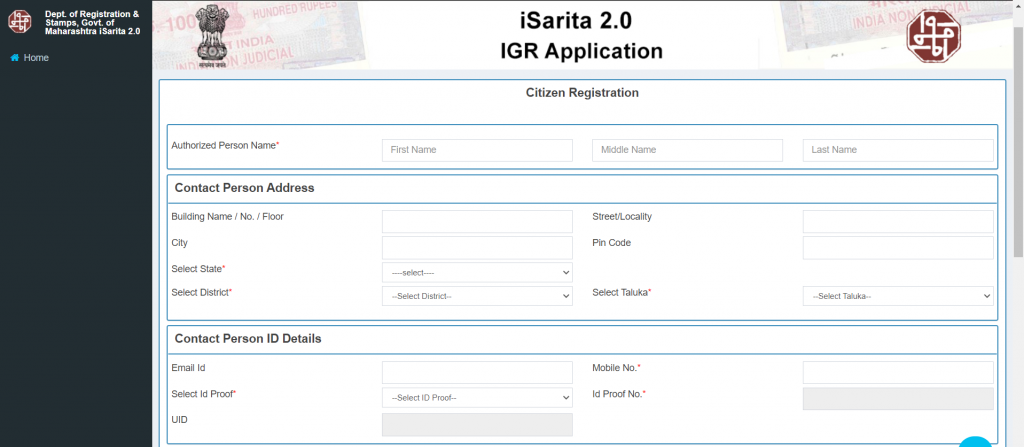

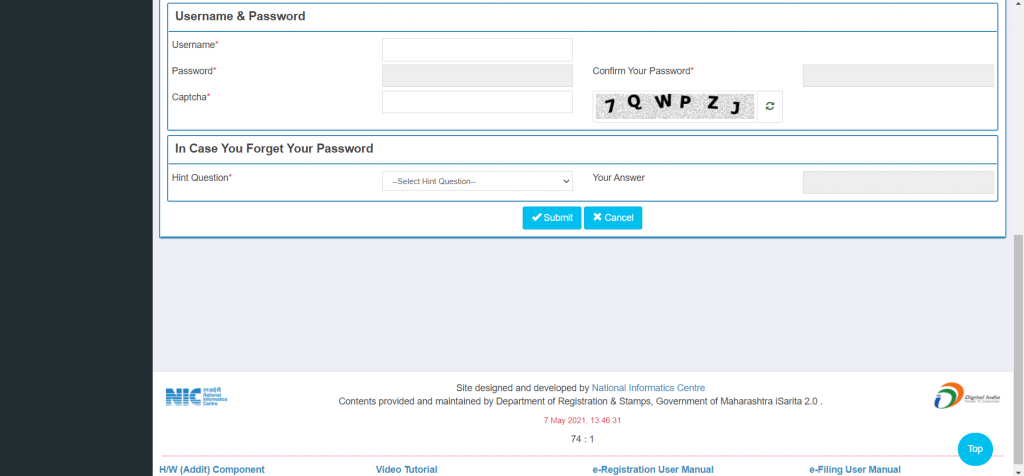

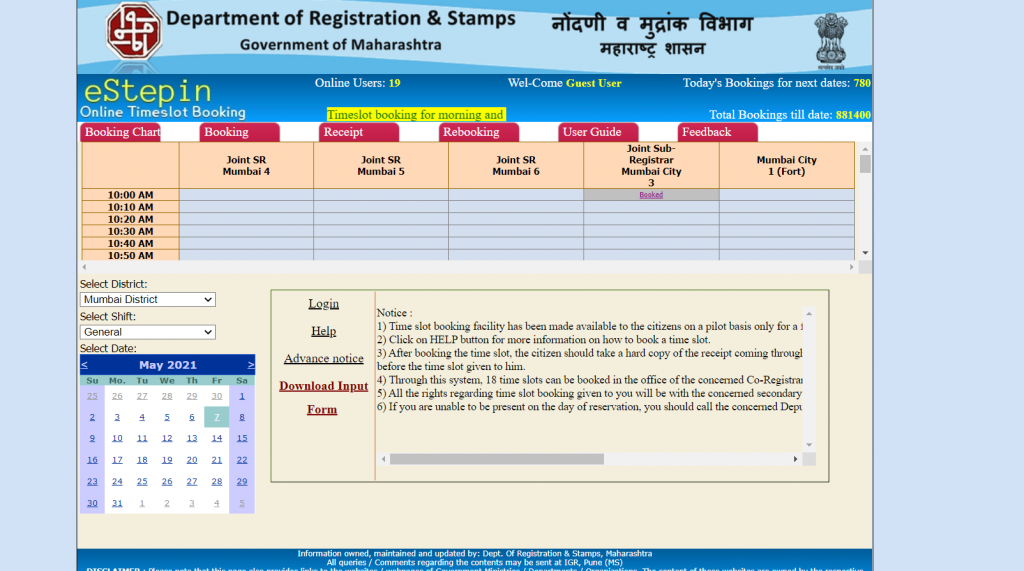

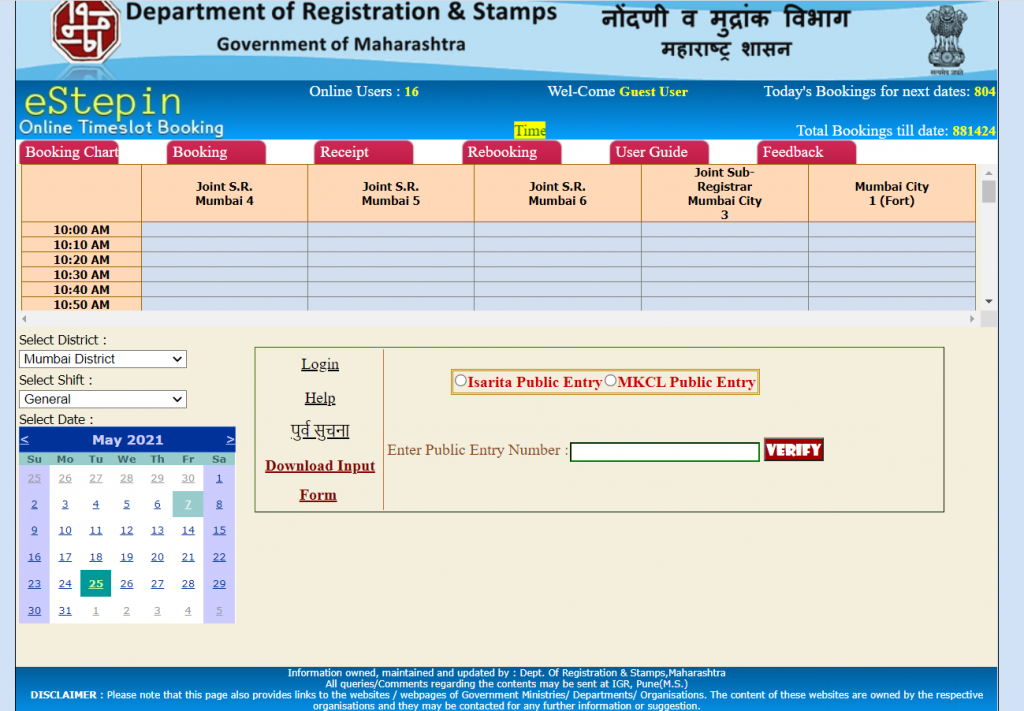

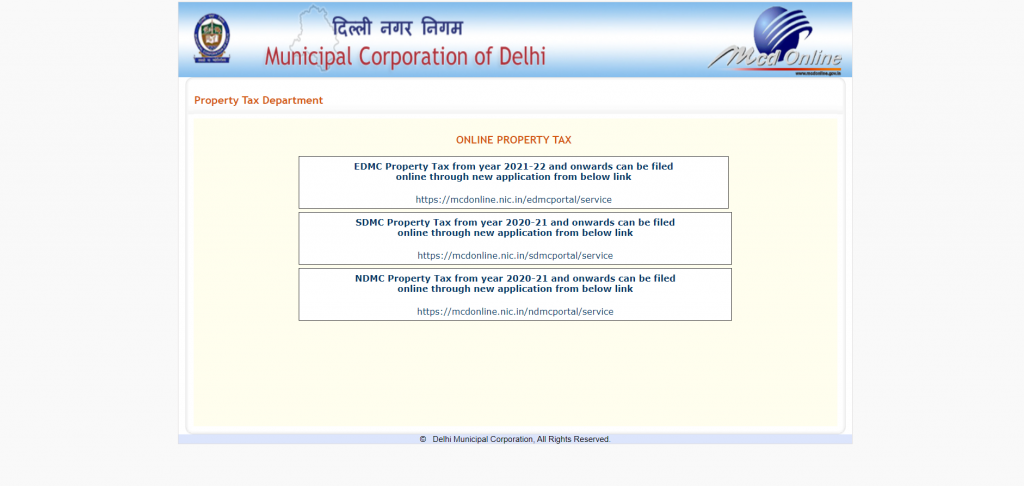

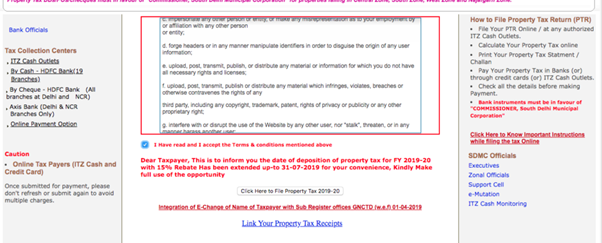

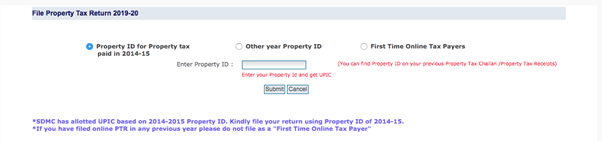

Stamp duty is the tax levied by the government on a legal document of ownership which is Sale Deed in this case. Its percentage varies from state to state. Before digitization, it had to be paid in the sub-registrar’s office, following a long-winded, step-by-step process. Though this option is still available, it can now also be paid online. It is easy, convenient, and goes a long way in taking on counterfeiting. Currently, Stock Holding Corporation of India Limited (SHCIL) takes care of all online registrations all over India except Mumbai. In Mumbai, online stamp duty is to be paid through the Government Receipt Accounting System (GRAS) of the Maharashtra Government.

Registration fees is the last part of advance payment and it is paid along with the stamp duty. It is 1% of the property value.

In a nutshell, it is best to ensure that agreement is made along with minimal advance payment.