Interest rates on home loans vary from bank to bank as well as person to person. The interest rate difference can increase the total amount being repaid to the lender by a sizeable amount.

Hence, it is vital and beneficial to keep the interest rate low. The best way to do this is to understand how a home loan rate is determined. Several factors work on forming a particular interest rate for every individual. Let us examine all those factors and see how one can reduce it most effectively.

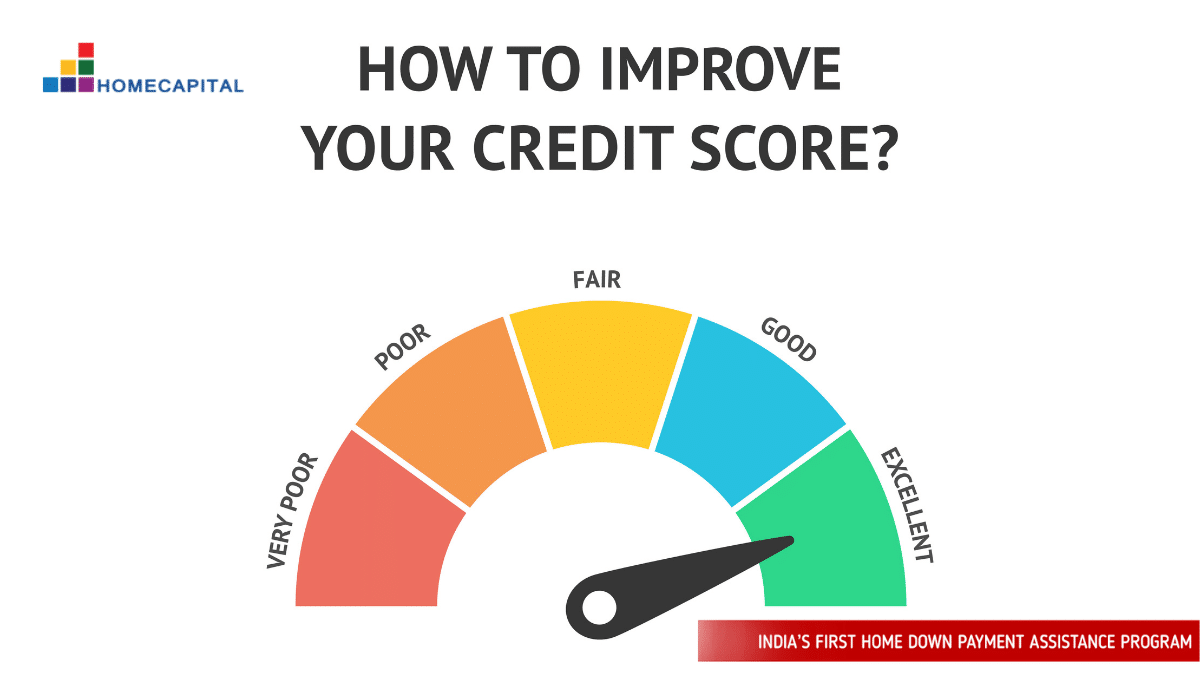

Credit Score

The credit score shows an individual’s creditworthiness and is an essential factor in calculating the home loan rate. A good credit score needs to be above 750. Lenders use the credit score to see how reliable you are in repaying loans. So, if you have a credit score in tally with the ideal benchmark, you will automatically get a reduced home loan rate versus someone who has an average credit score. Thus, before you go in for a home loan, check your credit report, and if there are any discrepancies, dispute them with the credit report company as it can lower your credit score.

Home Loan Amount

The higher the loan amount, the higher is the extent of credit risk for lenders, and hence, the home loan rate is also higher. Usually, the interest rates are divided across three ranges of loan amounts – up to Rs 30 lakhs, between 30-75 lakhs, and above 75 lakhs. The interest rate is the least for loans up to Rs 30 lakhs and maximum for the loans above Rs 75 lakhs.

Down Payment

It is a major factor in the calculation of the home loan rate. The central bank has advised all banks to approve up to 80% of the property value as a home loan (LTV). Thus, the remaining 20% has to be funded by the home buyer themselves. Usually, developers charge up to 20% of the agreement value towards the down payment. However, this varies across developers and the city in which the project is located. In case you have more savings than the required amount, you can make a higher town payment towards the house. There is no upper limit to the amount of down payment. This would also enable you to reduce the amount of home loan you ask from the bank.

Usually, the larger the down payment, the lower the interest rate you pay. This happens because the lender sees a lower risk level when you have already paid a sizeable amount for the property. If you can pay up to 20% of the property value as down payment, it will definitely help lower the home loan rate. If you want help with paying the down payment, HomeCapital, India’s first Home Down Assistance Program, would help you in doing so. It offers up to 50% of the total down payment at no interest rate to be paid in 12 equated monthly instalments.

Type of interest rate

There are mainly two types of interest rates – floating and fixed. Floating rates vary during repayment tenure based on the base rate. Fixed rates remain constant during the entire tenure. In most cases, it is observed that floating rates on home loans are lower than fixed interest rates. It is advisable to opt for a variable or floating interest rate when you can foresee that the interest rates will decrease in the near future.

Employment Status

Lenders are more comfortable giving loans to people with a fixed salary, preferably in the government sector, as they are sure of the repayment capability. So a salaried person vis-a-vis a businessman or a self-employed individual will be given a lower interest rate.

Marginal Cost of Funds Based Lending Rate (MCLR)

This is the lowest base rate that the bank can offer as interest. It is a reference rate for banks that is fixed by the RBI. MCLR mainly depends on the Cash Reserve Ratio and the Repo Rate.

Cash Reserve Ratio (CRR)

CRR is the least percentage of the total deposits that the customer makes for the bank to hold as reserves. It can be in the form of cash or deposit with the RBI. The higher the CRR, the higher is the home loan rate that you will have to pay. This happens because the amount of liquidity in the system is reduced with a high CRR.

Repo Rate

Repo Rate is the rate at which the RBI lends to the banks. The lesser the rate at which the RBI lends to the banks, the lesser will these banks lend to individuals. Thus, a lower repo rate equates to a lower interest rate for the end customer. The Reverse Repo rate is the rate at which the banks lend to RBI, so if this rate is high, the banks make a profit, which is passed on to the customer in terms of a lower home loan rate.

The home loan rate is the insurance the lender has for the risk it is taking. But you can easily keep this risk rate at the lowest, keeping in mind the factors mentioned above that determine home loan rates.