About the program

HomeCapital is founded on a simple yet powerful idea of solving the critical problem of helping home buyers overcome the challenge of making initial/residual payments. As a technology-driven company, with a mission to accelerate home ownership for a billion home buyers. Now with flexible repayment tenure of 3, 6 or 12 months EMI.

Check EligibilityProgram Highlights

Program Benefits

Illustrations

Consider the home price is ₹50 lakhs, which has a initial payment requirement of 10% (₹5 lakhs).

With the HomeCapital Program, you only need to pay ₹2.5 lakhs (50%) of the initial payment amount. The balance amount ₹2.5 lakhs (50%) is funded by the HomeCapital Program and would need to be repaid in 12 equal monthly installments, interest free.

Note:

- Personal Loan for Home Owners will vary as per your monthly net income.

- With this 3 EMIs Plan, there is a 2.49% (GST as applicable) Processing Fees of the total amount.

- With this 6 EMIs Plan, there is a 4.49% (GST as applicable) Processing Fees of the total amount.

- With this 12 EMIs Plan, there is Processing Fees upto 2% with leading developers subvention.*

Note:

- Stamp duty can be included in initial payment requirement in applicable states.

- Depicted figures are computed as per a monthly net income of ₹ 1,00,000 (HOPL amount will vary based on your monthly net income)

Note:

- Stamp duty can be included in initial down payment requirement in applicable states.

- Depicted figures are computed as per a monthly net income of INR 1,00,000 (DPA amount will vary based on your monthly net income)

Note:

- Stamp duty can be included in initial down payment requirement in applicable states.

- Depicted figures are computed as per a monthly net income of INR 1,00,000 (DPA amount will vary based on your monthly net income)

Eligibility Criteria : For any Indian resident with a stable income and sound credit track record

Your Personal Loan for Home Owners can also be calculated based on your city of preference.

View offeringsIt's easy to get started

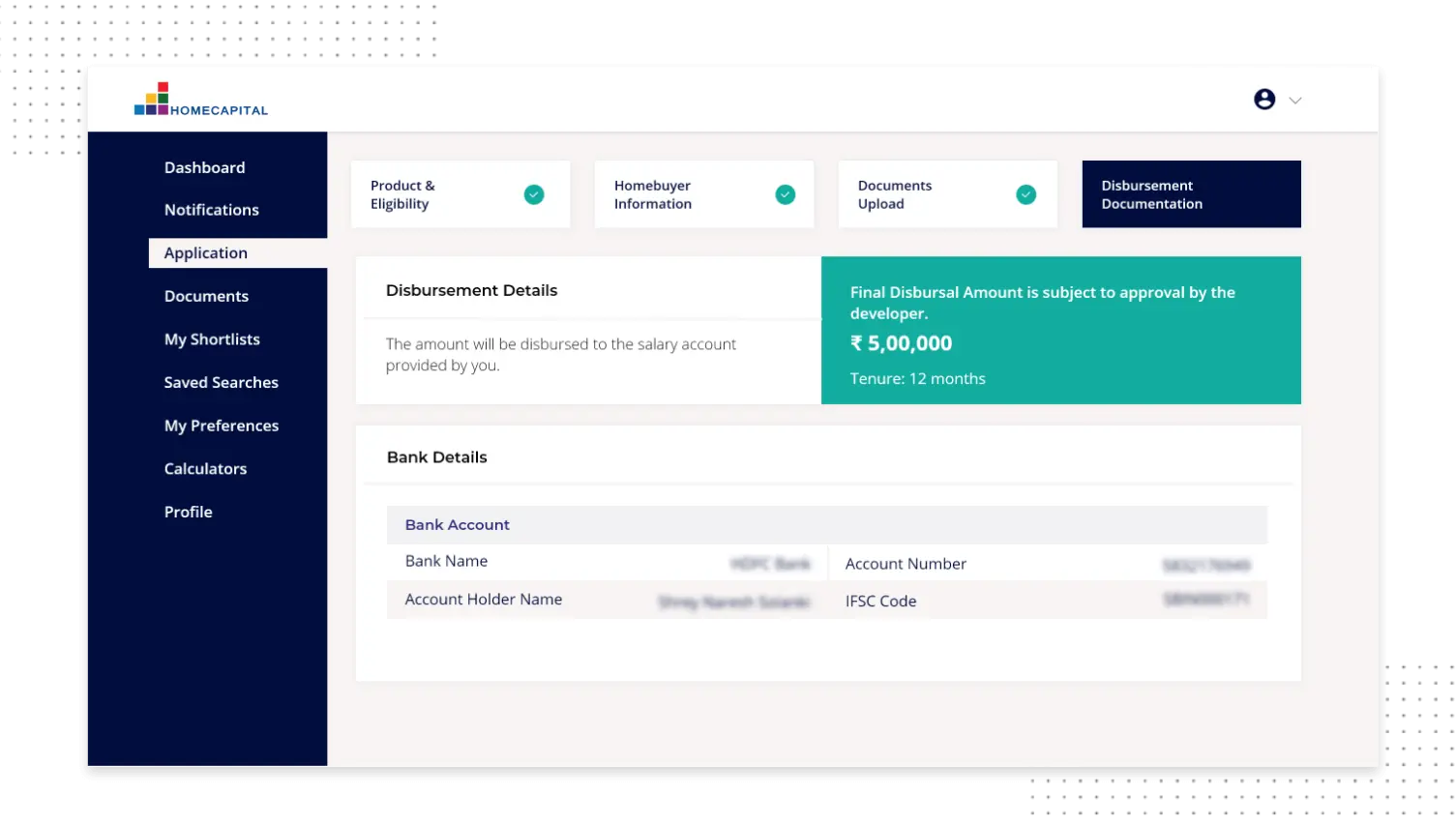

Fastrack your Home Ownership - in just 5 easy steps.

A completely digital journey with HomeCapital

For customers

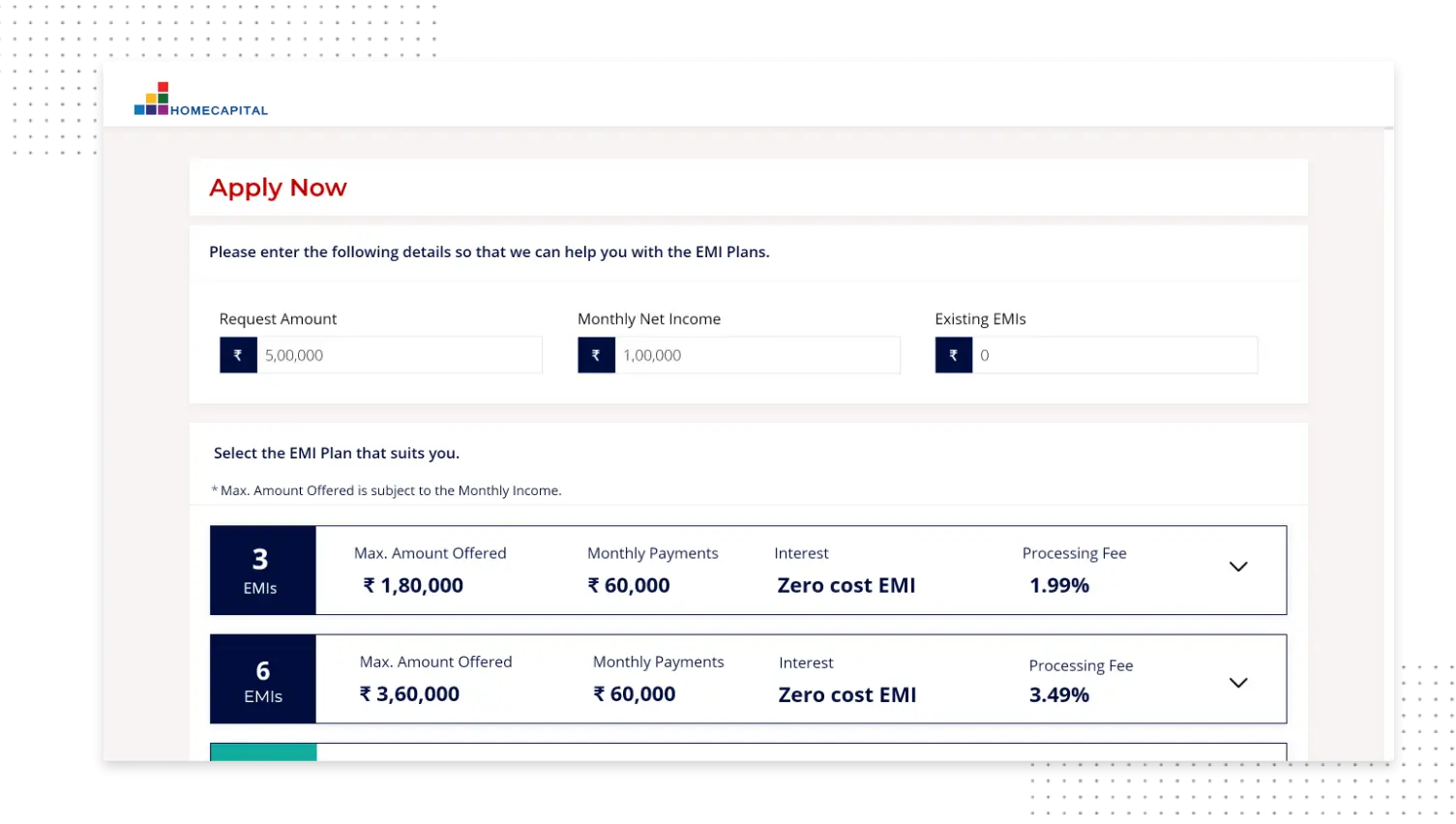

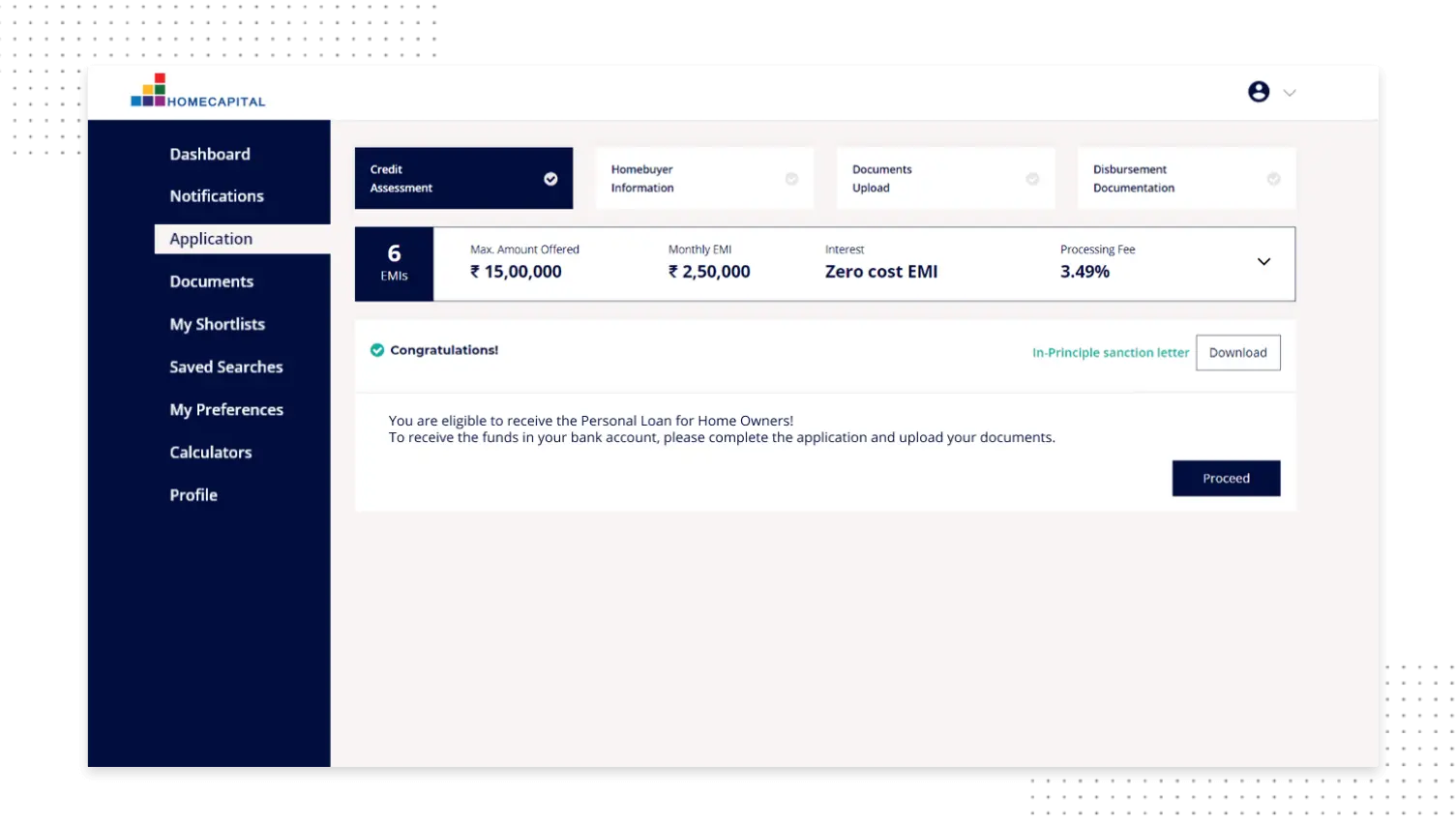

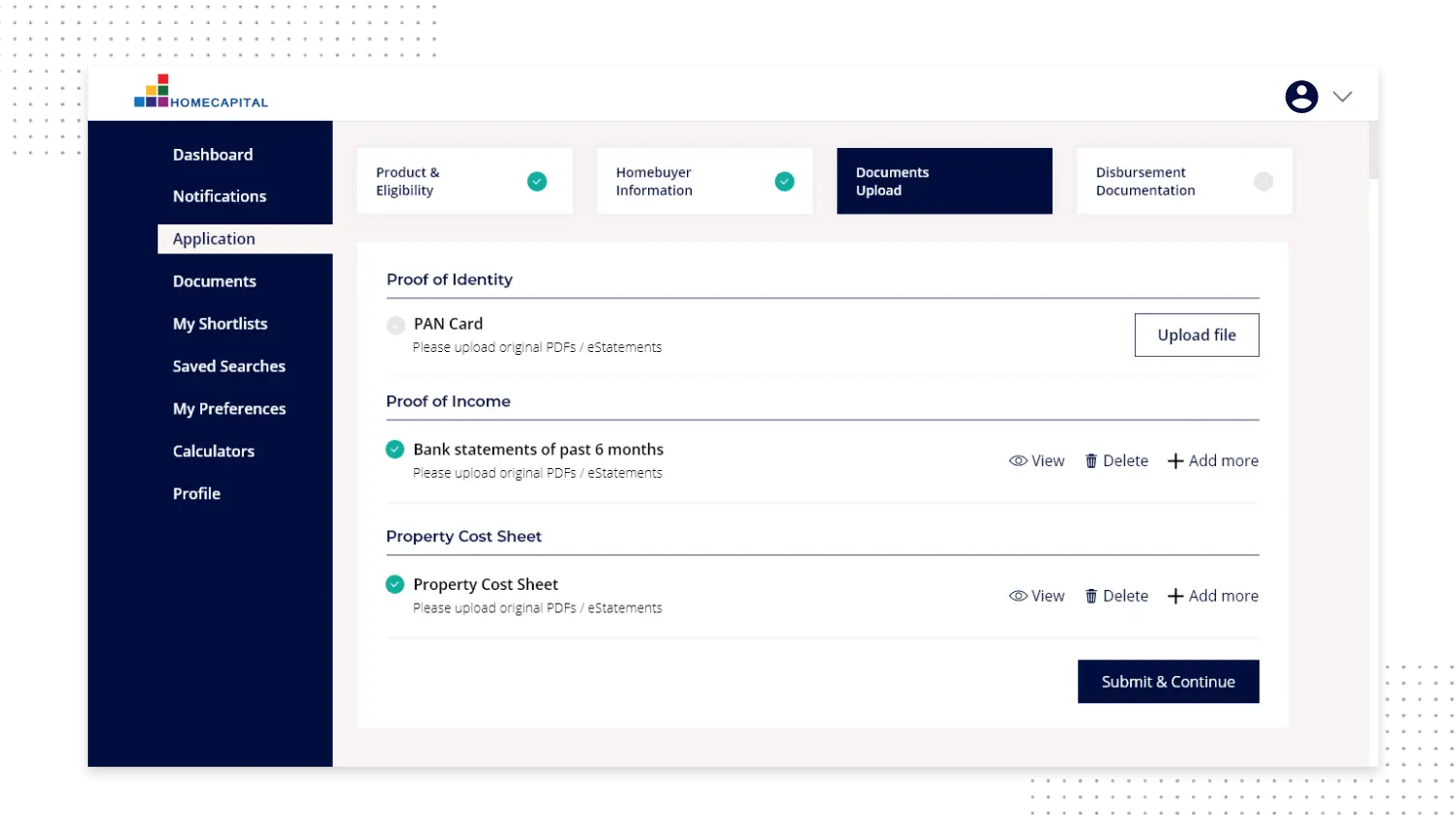

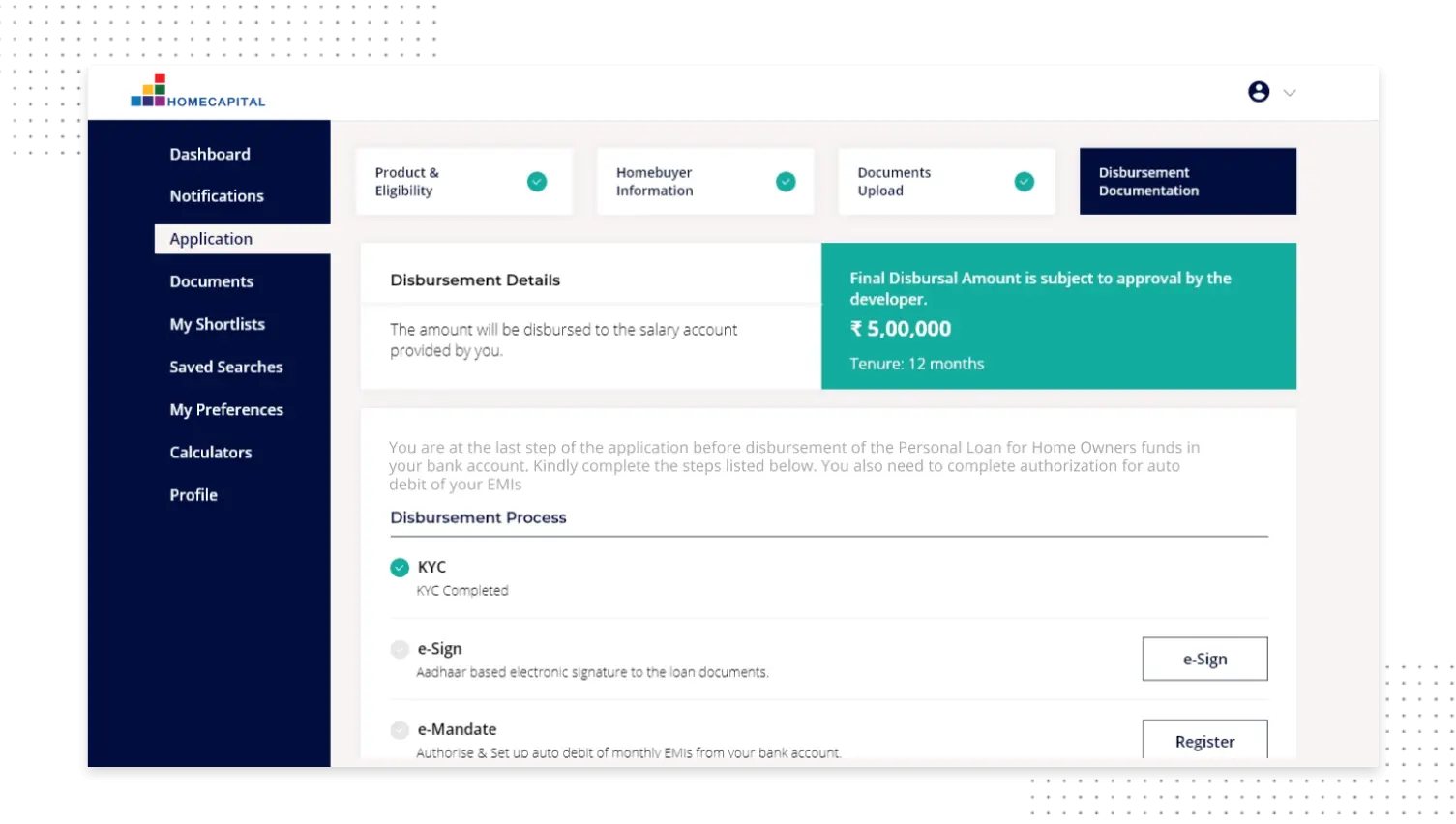

A simple application process through web or mobile will calculate your eligibility amount and give you an in-principle approval in real-time.

Start applicationFor developer partners

Accelerate home ownership for your customer by partnering with the pioneers of Personal Loan for Home Owners in India.

Partner with usDownload our user guide to begin

Read through our detailed guide to navigate your way through your application. For further questions, get in touch.