The concept of township is not new, as it existed in different forms in the past like a FORT can be termed as an ancient version of a township. In addition, various PSU or private sector companies and some institutional campuses give a feel of similar infrastructure developed to accommodate residential and workplace activities within a defined boundary.

Modern townships offer a more advanced and integrated version of community living, which has landscaped gardens instead of natural greenery, cozy commercial and retail outlets, leisure activity places and advanced playgrounds, healthcare, and educational infrastructure, etc. Such townships provide security and other amenities like a standalone building apart from all basic infrastructures inside the township. Homebuyers now prefer peaceful township living away from the urban chaos instead of a small flat with limited open space at a prime location in the city. In fact, homebuyers can also afford larger homes in these townships under similar or less budget.

During recent pandemic year, working professional have realized the value for better ventilated houses and societies which could also prove to be a sustainable accommodation for all including children, housewives, old age people and work from home individuals. Even, Covid-19 have made people think about a balanced life and if you can get it near your home with secured gated community that is good for all. So concept of owning a dream house is not just limited to a standalone building at a prime location, but the idea have emerged to get access to larger open spaces, proper green area, exercise and sports activity play areas along with other urban amenities at a walking distance, even a workplace or office. So, these add-ons are driving the concept of township living among all age groups to give themselves and family a little more.

Township Living: Concept and Planning

Integrated townships reflect a mini replica of the main city away from the main city with medical, educational, commercial hubs exist either inside or nearby the township project. For work-life balance such a township also houses plenty of open space covering landscaped gardens, jogging tracks, playgrounds for all age groups, parks and open spaces for enhanced living experience. Fully developed townships offers all the amenities of a city life within the periphery of the project with larger areas to eat, play, study, work and live.

Uninterrupted power and water supply minus urban traffic chaos and pollution, makes township living a different experience in totality. In addition to the amenities and convenience, township also offers balance of serenity and nature, which is a must aspect of living in today’s times. The project is designed in a way that it has better connectivity with main city and has plenty of green cover inside and around the project. Township living can be defined as urban amenities in nature’s abode, making a holistic living experience for the residents.

Benefits of Living in Township

Township living offers residential, commercial, green area and retail space inside the developed project. Homebuyers may get several benefits by choosing a property in township projects such as:

- Comprehensive infrastructure for living

Township projects are developed in a way that residents can have access to civic and social infrastructure at a convenient distance from their home. A typical township project houses hospitals, schools, shopping centers, green space along with residential towers.

- Work-Life Balance

Work-life balance is a key aspect behind a township living project. Most of these projects are developed strategically in the vicinity of major employment hubs in turn reduce the travel time and stress levels for working professionals.

- Better resale value and returns

Compared to standalone buildings, the townships score better due to larger landscape and amenities. Commercial spaces like SEZs also prompt buyers to these locations. Since such projects are located outside the city limits, the cost of land is much lower as compared to main city locations, which brings houses under affordable range to give better returns. A township home can be a dream home for most of the buyers, as it fits the checklist of a valued house. Current property market prospects favor homebuyers making it the best time for owning a beautiful home that matches your expectations.

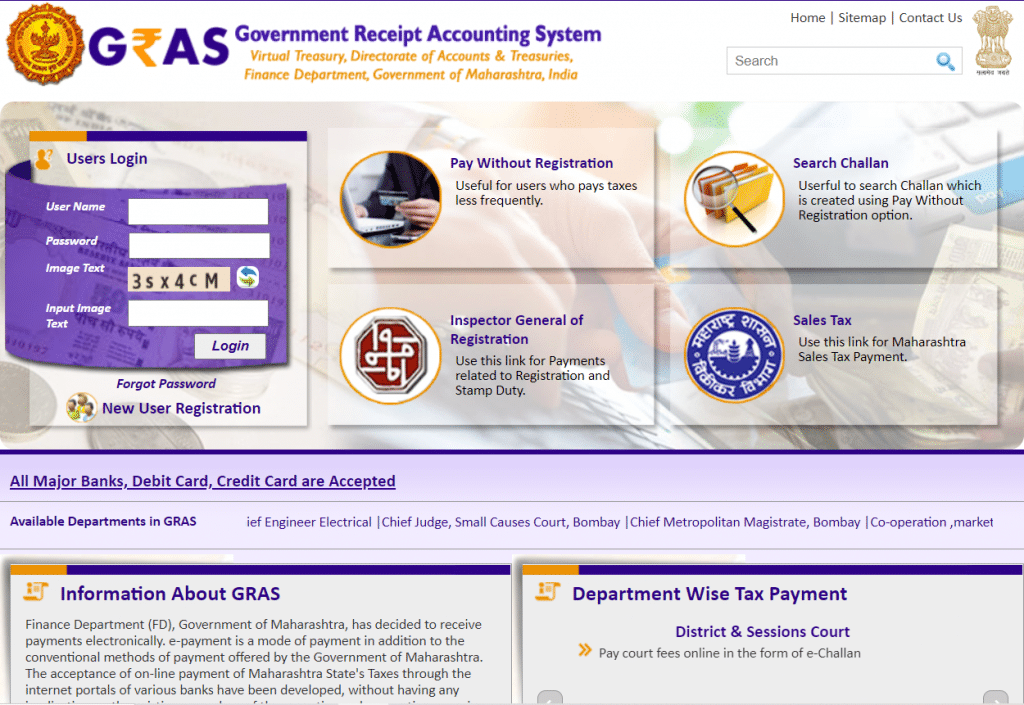

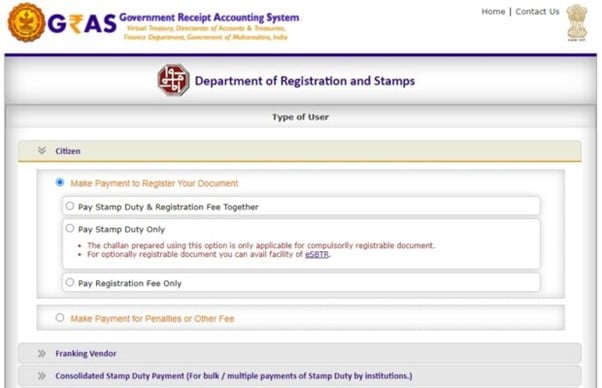

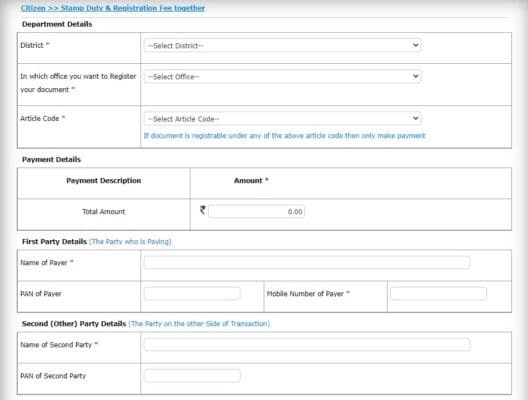

To assist new homebuyers who may need support for down payment amount, we offer affordable financing to them. HomeCapital offers support to purchase your first home with interest-free unsecured personal loan of up to 50% of the down payment, which can be repaid in 12 EMIs.

Ongoing Living Township Projects:

There are some promising township projects that are worth considering for new homebuyers. Individuals, who are looking for a complete abode that can fulfill their aspiration as well as idea of a healthy lifestyle, can check the specification and amenities these township living projects are offering.

- Pallava City – is a township project by the Lodha Group and has over 1 Lakh apartments. It is located at the junction of Thane, Navi Mumbai, and Kalyan. Pallava City is spread over 4500 acres and has over 60% open space.

- Shriram Sunshine One – is a part of the Shriram Grand City township. It is spread over a total area of 314 acres of land in Uttarpara, Kolkata. The project has 2343 units