The good news continues for new home buyers. The latest relaxation in the income tax rules reduces the tax burden of both, developers and buyers. It will make selling properties easier for the developers and make homes more affordable for buyers. This measure, along with the previous few, is aimed towards rejuvenating the real estate sector and making home-buying more affordable. As per an Anarock report, there are around 5.45 lakh homes, priced up to ₹1.5 crores, sitting unsold in the top 7 cities across the country. The situation looks equally bleak for higher-priced properties. Though this measure will remain in effect until 30th June 2021, it will greatly benefit new home buyers.

So, what’s the good news?

Section 43CA of the Income Tax Act caps the differential between circle rate and agreement value at 10 percent. Earlier the difference between the circle rate and agreement value could not be more than 10 percent. This threshold limit had been increased by the government from the earlier 5% level in the budget 2020. This meant that the developer could sell a property at up to 10% lower price than the circle rate. Anything more than the limit was taxable for the buyer as well as the seller as this difference is considered to be additional income. But with this latest development, the government has doubled the differential and raised it to 20% for new homes valued at up to ₹2 crores. Developers are expected to pass on this benefit to new home buyers and quickly move their unsold inventory.

But how does it help the homebuyers? Before we look at the benefits for home buyers, let us first understand what circle rate is and how it determines the price of a house.

What is Circle Rate?

‘Circle Rate’ is the minimum price set by the government below which no property can be registered in the government’s records. It is also known as ‘Ready Reckoner Rate’. These rates are based on the current market values of the areas. E.g., Mumbai has 19 zones for which circle rates are specified. They are fixed by the Stamps and Registration Department of the city. The circle rate for a commercial property is always higher than that of a residential property.

When a property is being valued, the circle rate is compared with its declared transaction value. Whichever of them turns out to be higher is then considered for stamp duty calculation and payment. If you’re curious about how the circle rate is calculated, the following factors determine the circle rate.

- Existing market value of the area.

- The level of amenities and other facilities in the area.

- Whether the property under consideration is residential or commercial.

- Whether the property is an apartment, row house, bungalow or a plot.

- Open Parking – Area of the parking slot x 40% of the area’s circle rate.

- Covered Parking – Area of the parking slot x 25% of the area’s circle rate.

- Floor rise

- 0% up to 4th floor

- 5% for apartments between 5th and 10th floors

- 10% for apartments between 11th and 20th floors

- 15% for apartments between 21st and 30th floors

- 20% for apartments above the 31st floor

All these considerations together help in calculating the area’s circle rate.

How does it help new home buyers?

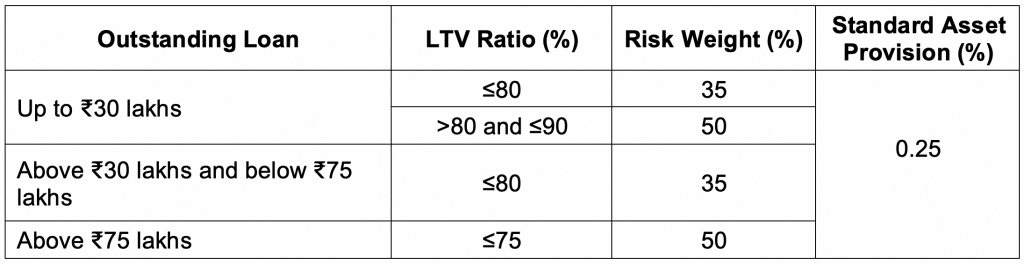

With the differential now doubled, developers can now sell their properties at 20% lower than the area’s circle rate without incurring additional tax burden. They can now offer increased discounts, which would mean home buyers will have to pay less for their new homes. It is an added incentive over and above the recent rationalization of risk weights by the Reserve Bank of India. Let’s look at a simple example to see the effect of this move.

| With 10% Differential | With 20% Differential | |

| Circle Rate (In ₹) | 1,00,00,000 | 1,00,00,000 |

| Agreement Value (In ₹) | 90,00,000 | 80,00,000 |

| Total Savings (In ₹) | 10,00,000 | 20,00,000 |

The table above clearly shows that this new move can potentially double the savings in the home buying process. This coupled with additional offers and discounts from individual developers will make your new home pocket friendlier.

Additional assistance for home buyers

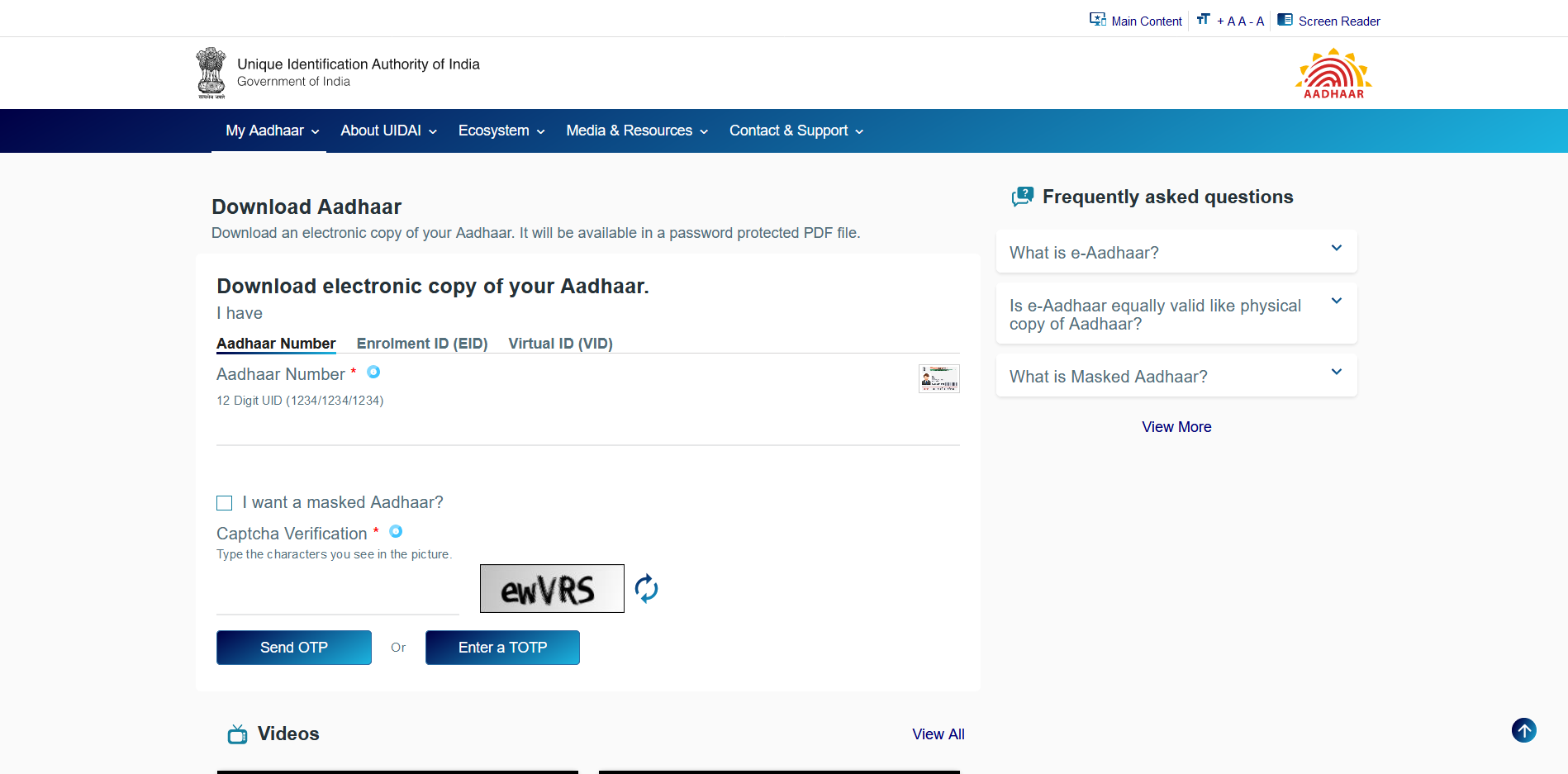

An overwhelming majority of new home buyers avail a home loan while buying a house. While a loan is relatively easy to procure, most face an unexpected obstacle, down payment. But even that barrier is now easily surmountable with HomeCapital, India’s first home down payment assistance program. It shares the burden of your home’s down payment in a straightforward manner.

Now that the differential between circle rate and agreement value has been doubled, it could significantly reduce the cost of your new home. That, coupled with HomeCapital’s home down payment assistance program, will further help you to save more money. The signs are all there. With this latest income tax relief, the series of consumer-oriented relief measures from the government have aligned at the right time for you to fulfill a cherished dream, buying a new home. If you were waiting for the right time, this is it.